Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

Copper prices are flat amid low volumes and as Chinese demand gradually slows down. Three-month copper on the LME was up 0.1% at $7,680 a ton and Comex copper as of this writing was trading at 3.4975 just shy of 3.500. Stock piling by Chinese producers certainly has helped drive the price to the highest levels in a long while intraday price speculators like us here at TradeGuidance have been riding the coattails of the market makers who are driving these prices higher. A time will come when the stockpiling by countries like China will cease or run out of steam as price inflation rules. The demand is more conceptual at this point than real as world economies cautiously return to a methodical working structure.

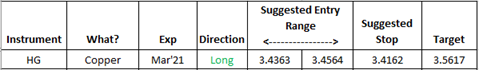

At TradeGuidance, we have traded Copper successfully over the past few sessions and are currently long using this setup which still has room to float higher:

Silver

Earlier today, silver markets stalled at the 50-day EMA during the early trading session to consolidate some of the major gains accumulated on the previous day. The markets were quite volatile repeatedly testing these levels.

The 50-day EMA [which we rarely use here at TradeGuidance but is still worth noting] is around $24, which doubles up as the middle of the general consolidation. Additionally, there was a major upside movement on the last trading day in November 2020 as traders took a breather from a month of price runup from the interim bottom and profit taking from shorts.

It appears too that the greenback is back today to try and make a run against its comparative basket of currencies. Buying pullbacks appears to be a workable trading strategy for intraday traders who could extend such positions to slightly longer-term bets.

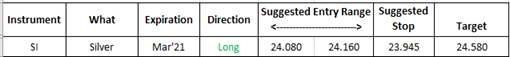

We have traded Silver intraday and are currently holding this trade from the Suggested entry range:

Fill out a contact form to request charts or ideas for any other instrument you may like for us to price analyze for your trading needs. We will attempt to do our best.