Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

The PPI for final demand increased 1.0 percent in June, seasonally adjusted. Final demand prices rose 0.8 percent in May and 0.6 percent in April. The signs of a strengthening economy has boosted futures prices here into the late premarket. Later today we have Chair Powell on the docket and his testimony to the Congressional Committee surely can sway markets one way or the other. The market profile is showing sellers at the top as always facilitating the squeeze higher into the news. We have gapped up nicely from yesterdays’ settlement therefore gap rules do apply. This is a news based push higher and corresponds with the news based push lower from yesterday. As we sit right now and into the Fed Chair’s testimony later today, we could go either way as inflation and the variant in the virus, according to analysts, remain the topmost concerns for the markets. Equities markets appear bullish especially the Nasdaq which continues it’s run up and is determined to take out the 15K handle.

Possible scenarios and outline for trade positioning

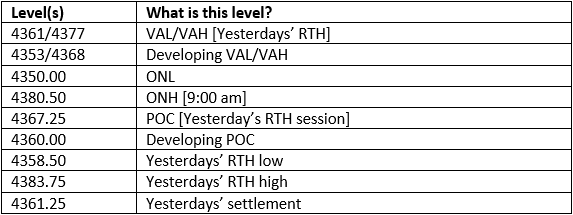

Key Levels to factor for the intraday price movement.

TPO Profile mapping