Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

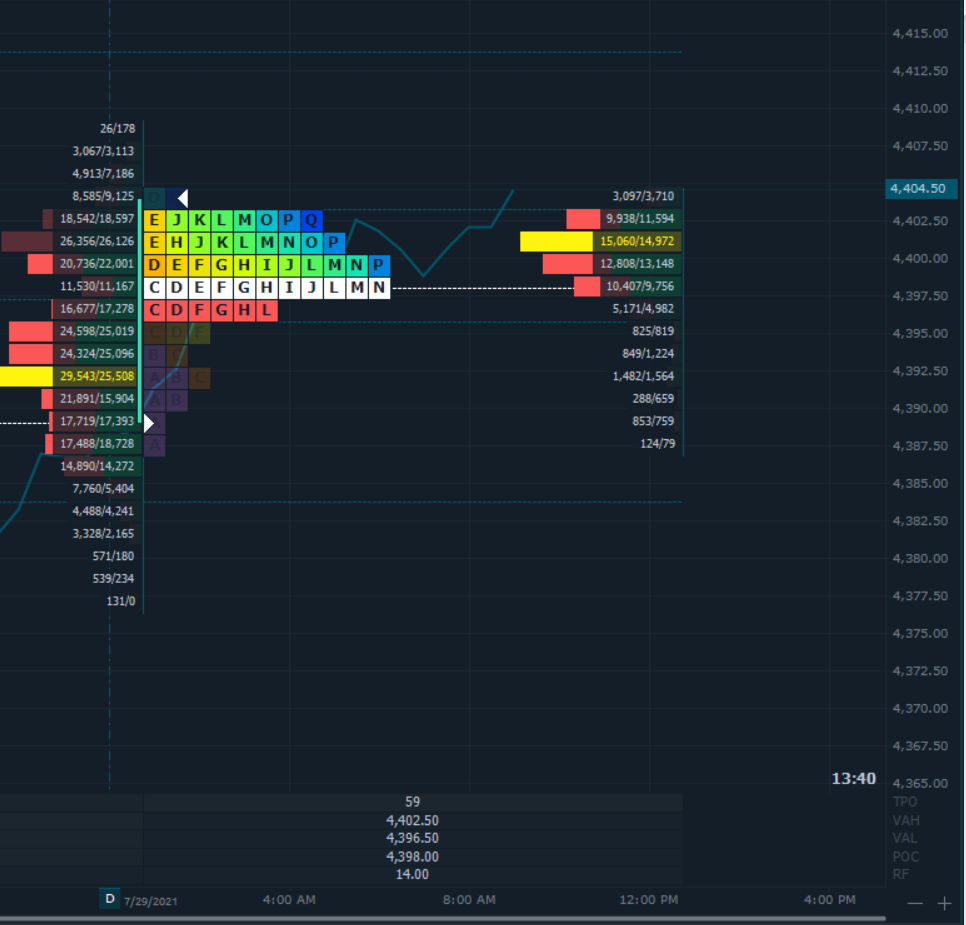

Slower growth is expected in coming months, with Delta variant of Covid-19 and materials and labor disruptions clouding economic outlook. U.S. gross domestic product grew at a 6.5% annual rate in the second quarter, up slightly from earlier in the year, pushing the economy’s size beyond its pre-pandemic level. The growth came as business reopenings and government aid powered a surge that is expected to gradually slow in coming months, with Covid-19 variants and materials and labor disruptions clouding the outlook. We are currently trading nicely above yesterdays’ settlement of 4393.75 so gap rules are applicable. Valuation again remains unchanged and now we are into the tail-end of the big tech earnings with Amazon reporting after the close today. This was by far the heaviest week in terms of tech earnings and we now have a few of the S&P still to report in the coming weeks of course followed by those in the Russell which has been resilient to say the least, in the past few days. Precious metals is attempting a comeback with the gold futures rolling to December contracts and that should bring some new life into the market while keeping the USD a bit subdued while yields remain a whole different ball game. Yesterday the FOMC report did mention tapering and that it was in the horizon with no specific date while reiterating that inflation was transitory. Ironically, like the past FOMC events, we did not liquidate much after the Fed speech although we will perhaps learn more next months when the complete minutes of these meetings are revealed and published. Overnight inventory is mixes so there is no way to determine accurately which way the pendulum will likely sway today.

Possible scenarios and outline for trade positioning

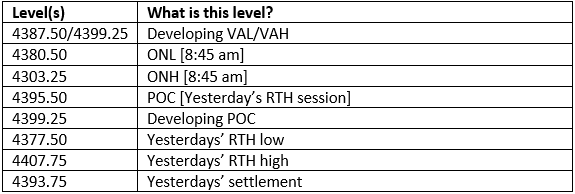

Key Levels to factor for the intraday price movement.

TPO Mapping