Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

Economists estimate new jobless claims fell slightly last week, a sign of labor market momentum. We open today in the backdrop of the customary weekly unemployment numbers from the Labor Department. We will have to see what the actual numbers are at 8:30 am EDT today but usually, these numbers get adjusted into the following weeks as numbers stream in after today and adjustments are made to weekly numbers. After the close today, we have a Dow component in Disney announcing earnings. Futures are virtually flat from yesterdays’ settlement so there aren’t gaps to worry much about into the open. Valuation remains intact as buyers and sellers appear equally positioned typical of range bound conditions and when indecision at market highs always prevails. Yesterday, in bond markets, the yield on the benchmark 10-year Treasury note ticked up to 1.349% from 1.339%. Also expected for 8:30 a.m. is the U.S. PPI for July, which will be closely scrutinized by participants for more clues on inflation at the wholesale level. At the time of this writing at 8 am, 40 contracts traded at the high above 4444 and all 40 sold. Regardless, there are fewer buyers today in the premarket above yesterday’s RTH.

Possible scenarios and outline for trade positioning

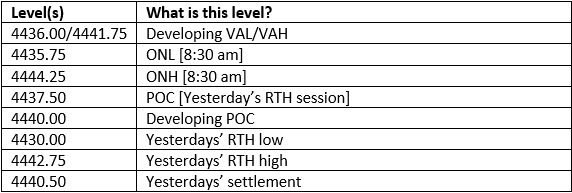

Key Levels to factor for the intraday price movement.

TPO Mapping