Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

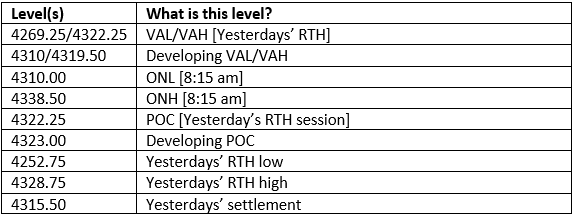

Overnight inventory again today remains net short and the high as of this writing was also the tag of a Fib extension profit target as we see the futures recede from that ON high. At the time of this writing [7:45 am EDT], we see Fib support coming in at 4316.25 and that has more contribution from the tech heavy Nasdaq which saw the actual start of earnings reports from names like Netflix. There isn’t much in the economic calendar of events for today other than Crude Oil inventory. At the time of this writing, we have traded a tad below that support level and however at the time of this writing, holding above that ON low of 4310.

Possible scenarios and outline for trade positioning

Key Levels to factor for the intraday price movement.

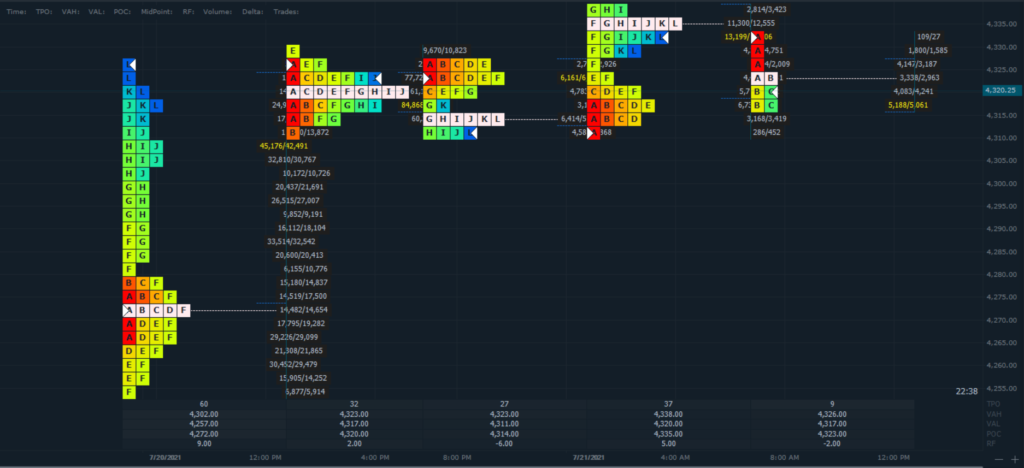

TPO Chart