Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

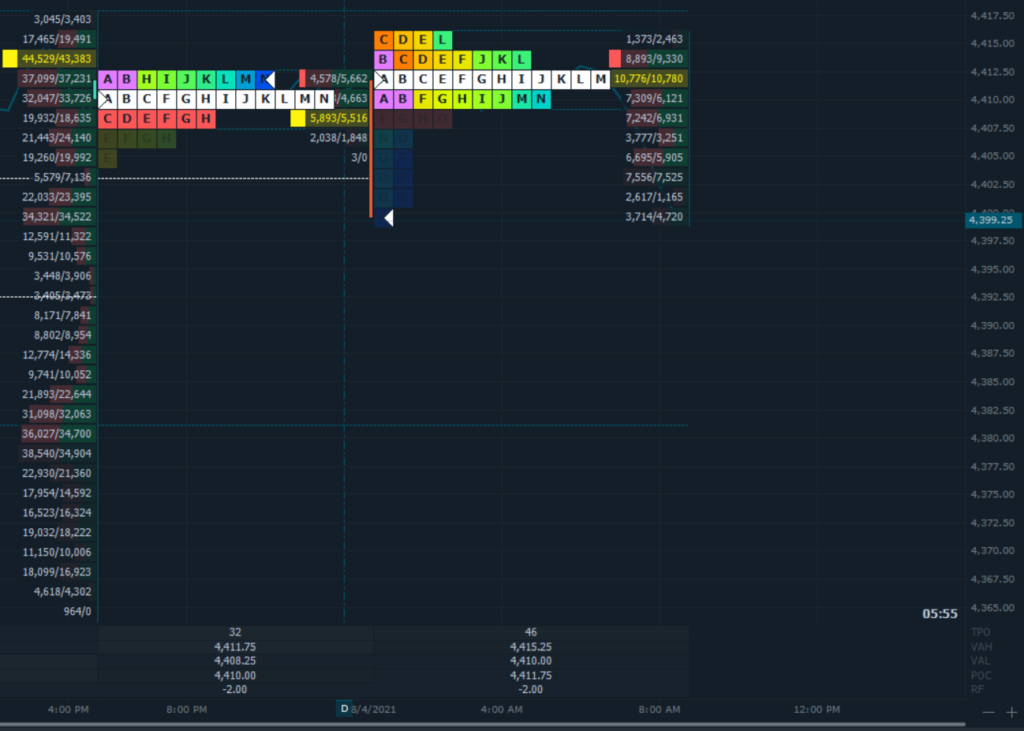

U.S. stock futures slid and government bonds rallied Wednesday after data showed that the private sector added fewer jobs than economists expected in July, fueling concerns that the rebound may be faltering. ADP showed that 330,000 jobs were added by the private sector in July, almost half the number that economists were expecting. In bond markets, the yield on the benchmark 10-year Treasury note dropped to 1.146% from 1.174% on Tuesday. Yields move inversely to price. ON participation is a bit tilted toward the buy-side despite the fact that the futures ticker is moving lower indicative of participants wanting to protect the 4400-price handle. It is going to be bit of tussle today to keep higher than yesterdays’ RTH High. Valuation, however, remains intact with the Tech heavy Nasdaq futures holding support here into the morning and will be key to the success of the broad market futures staying above 4400.

Possible scenarios and outline for trade positioning

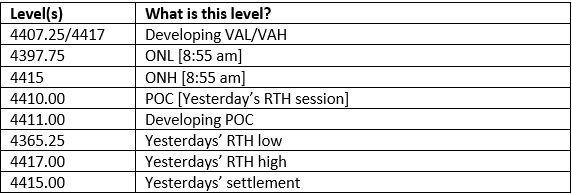

Key Levels to factor for the intraday price movement.

TPO Profile Map