Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

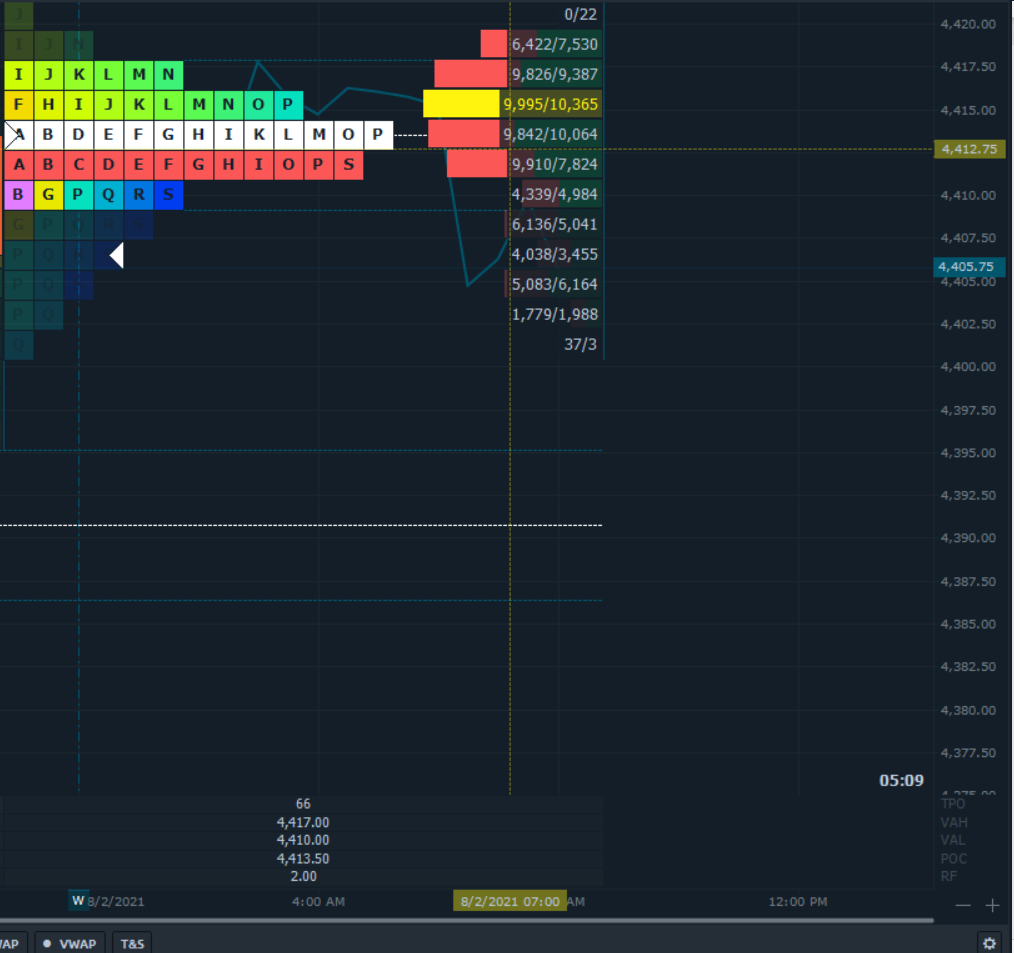

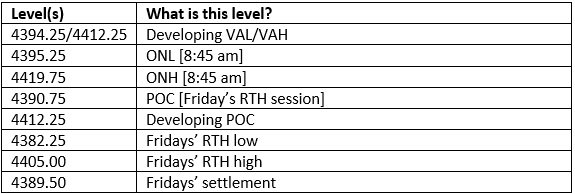

The ON high took us close to 30 points above Friday’s settlement and stalled as the ticker recorded no buys above 4419. Again, valuation from the break lower this past Friday remains intact as we stalled below 4385 and which will likely provide support to the markets during the day session here on Monday. Of interest today would be to watch the NQ which was the fastest index moving lower off the news last Thursday after earnings and guidance announcement by Amazon, and could find some return to value from that liquidation break lower. Usually, Mondays’ provide better opportunities for stocks versus futures. We could find support above 4401.25 failing which there is a solid level of support at 4488.25. Holding above 4407.75 into the open will find sellers again today at the ON high.

Possible scenarios and outline for trade positioning

Key Levels to factor for the intraday price movement.

TPO Mapping