Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

As mentioned in yesterdays’ premarket analysis, the grind higher past the settlement yesterday led to futures taking out the 4300-price handle and top out at 4305.75. Initial Jobless Claims for June 25th 364,000 thousand vs 390,000 thousand consensus estimate. The prior reading was 411,000 thousand so the signs of an economy returning to work after the worst pandemic in decades is positive and should grind us higher is what I am thinking. It is a bit difficult to predict which way we lean on this first day of the month. Futures valuation looks positive into 4294 and weaker on moves higher as the number of sellers increase as we march up the ladder into that ONH as you will see from the TPO mapping below. There is no measurable gap at the time of this writing so I will curtail my comments till we sit at least an hour past the open.

Possible scenarios and outline for trade positioning

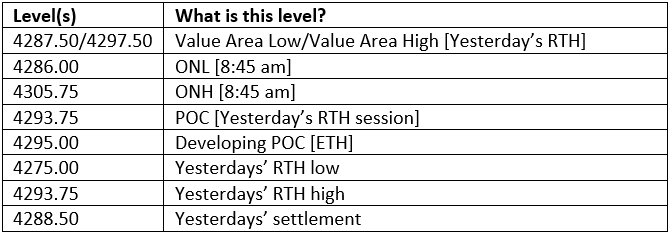

Key Levels to factor for the intraday price movement.

TPO Mapping