Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

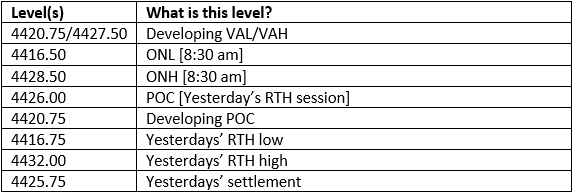

Futures are pointing toward a quiet trading session today as participants assess the latest government data to gauge the damages of the Delta variant of coronavirus on world economies. Meanwhile, European markets were lifted by stronger than expected earnings, with the pan-European STOXX 600 up 0.25% to an all-time high of 471.9, and analysts raising its 12-month target for the index to 520. Valuation remains intact and only trading below 4391.25 will now cause some concern for traders who continue to remain long. Point of Control form yesterday RTH session saw approximately 100,238 contracts traded at 4426 with the highest volume here in the premarket sitting just a point below at 4425 and at that price point, buyers outnumbering sellers 13,901 to 11058. There isn’t much of price movement from yesterday’s settlement other than the move lower after the futures open yesterday so not much to speak of in terms of change in value for today.

Possible scenarios and outline for trade positioning

Key Levels to factor for the intraday price movement.

TPO Mapping