Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

There is participant anxiety here ahead of Q2 earnings and it is justified. Although I believe that we will merely grind up over the course of earnings, the Nasdaq could be approaching a ceiling in its’ run up and that could lead to some consolidation. Looking beyond my opinion which isn’t really worth much, what I am seeing from the ON futures price action is that we rejected the highs above 4363 and sought out the lower end of the Fib long extension below 4343.75. Value did not degrade much on this ON move lower and I strongly believe participation will tend towards attempting to grind this higher and make newer highs. In the world of interest rate speculation and tapering of liquidity by the Federal Reserve, longer term yields are edging lower as market participants await a batch of important economic reports, notably data on inflation, due later in the week, as well as Fed Reserve Chair Powell's testimony on Capitol Hill on Wednesday. In the near term, participants will likely key in on a 10-year Treasury auction after it slipped below 1.3% last week, hitting a low not seen since February.

Possible scenarios and outline for trade positioning

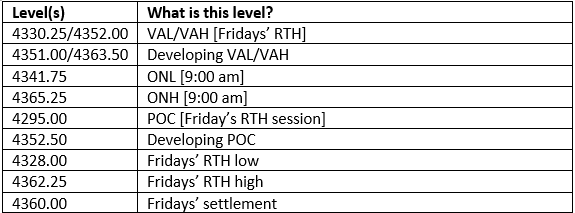

Key Levels to factor for the intraday price movement.

TPO Mapping