Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

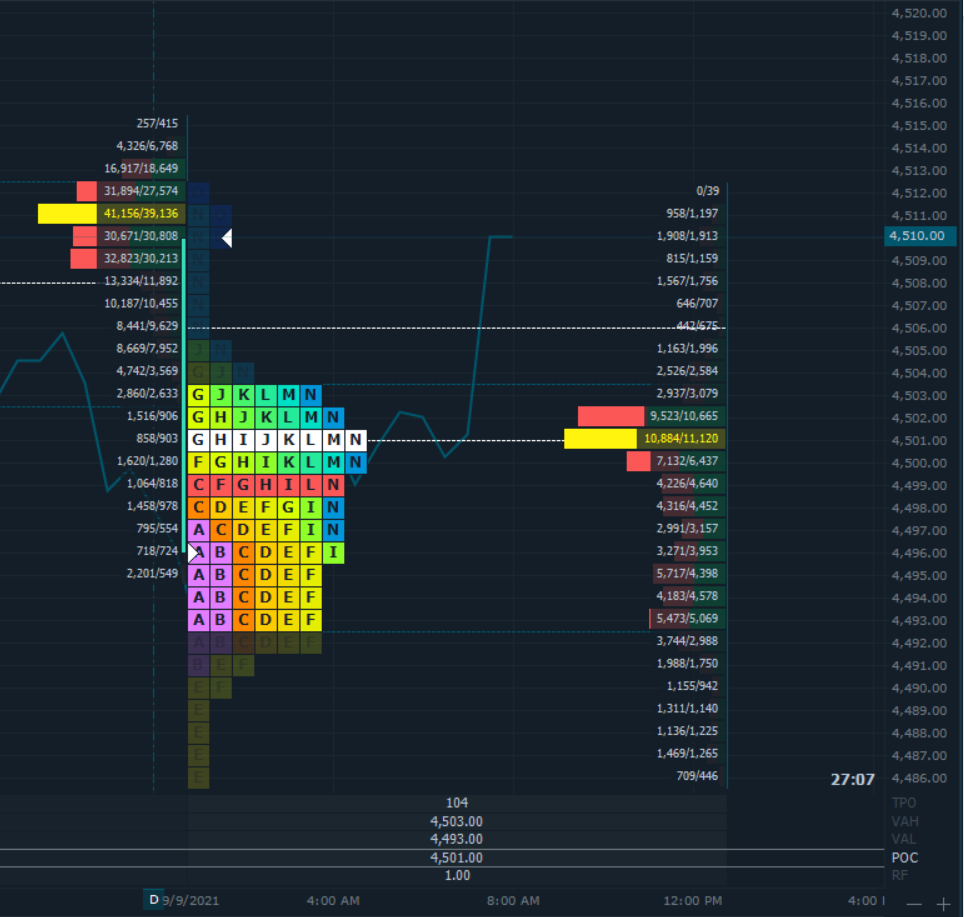

The analysis today references December’21 expiration contracts since brokerages have rolled for new trades to the front-quarter which is now December. Stock futures have fallen since the open [4501.75] to a low at one point in the ON session to 4476.25 and at the time of this writing are 0.28% lower from yesterday’s settlement. Stocks in Hong Kong pressed lower as well after China pressed on with online-gaming restrictions. The Nasdaq futures too showing some traits of trend exhaustion and pulling lower by 0.21% in the early session ahead of 7 am EDT. The ECB on Thursday indicated it would conduct asset purchases under its pandemic emergency purchase program, or PEPP, at a "moderately lower pace" after accelerating purchases in recent quarters. Based on a joint assessment of financing conditions and the inflation outlook, the Governing Council determined that favorable financing conditions can be maintained with a moderately lower pace of net asset purchases under the PEPP than in the previous two quarters. The ECB said PEPP purchases would continue with an envelope of 1.85 trillion euros through at least the end of March 2022. Meanwhile, volume yesterday in the September Emini S&P contract [which is more relevant for today] was approx. 1.278M and open interest is showing 2.577M. The short-term range for the December contract is between 4451.75 and 4539.00 and if we were to turn lower today in the RTH expect buyers to emerge if prices drops to between 4416.25~4439.75 as that is a previous value area and VPOC.

Possible scenarios and thoughts for intraday trade positioning:

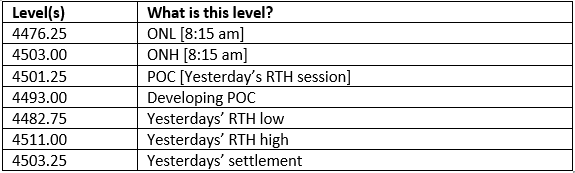

Key Levels to factor for the intraday price movement.

TPO Profile [references September contract for value area study]