Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

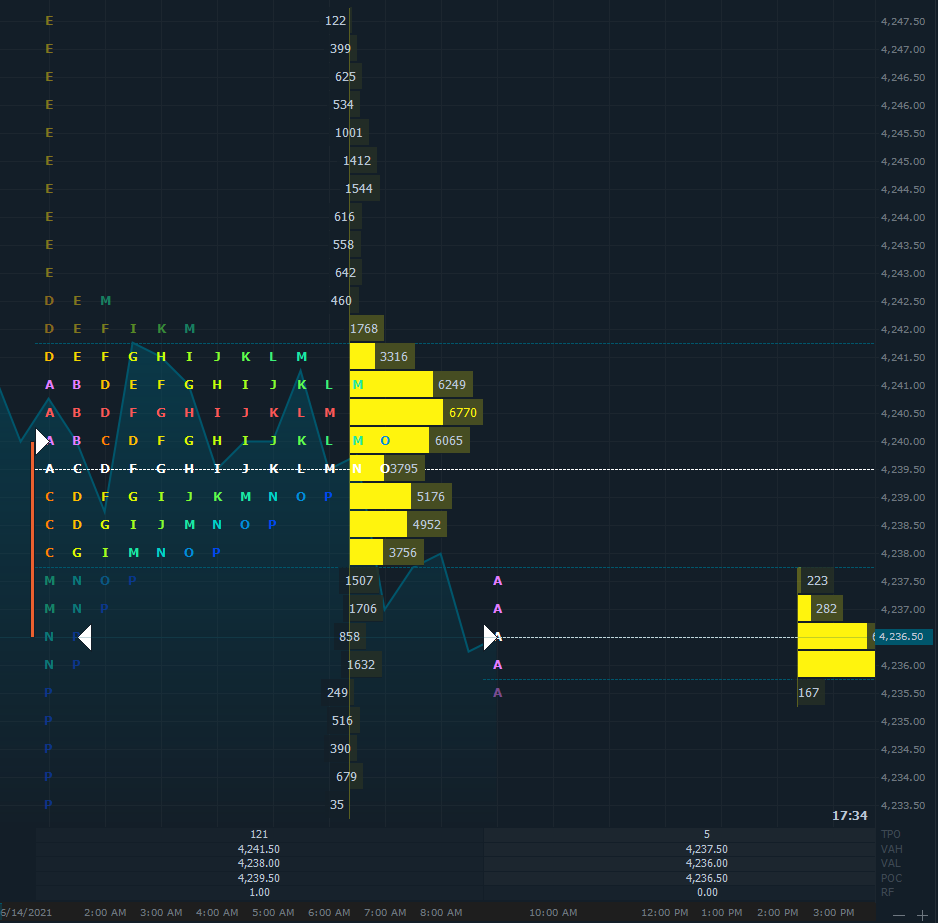

There appears to be resistance above 4242 today in the early survey of futures participation in what will be the first full week where we actively work with the September expiration contracts for the Emini index futures. Volume still remains split and has not entirely transitioned over to the September expiration and will more than likely occur this Thursday after about 3 pm when most of the futures roll over to the front-quarter occurs. Overnight Point-of-Control sits at 4240.50 and futures have pulled a tad bit lower. Friday, we settled at 4236.50 so we are practically flat from that point of reference. There is not much of analysis in terms of value that we can offer this morning other than the fact that value hasn’t deteriorated much and the fact that long trade participants need to be cautious as we could see some profit taking at these levels which could involve a reasonable move lower and that could occur with nothing in the economic calendar agenda like today.

Possible Scenarios

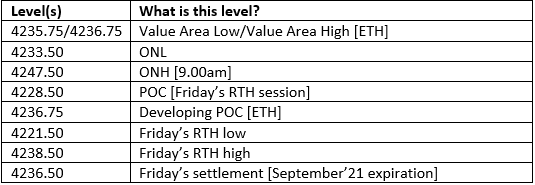

Key Levels to factor for the intraday price movement.

TPO Chart