Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

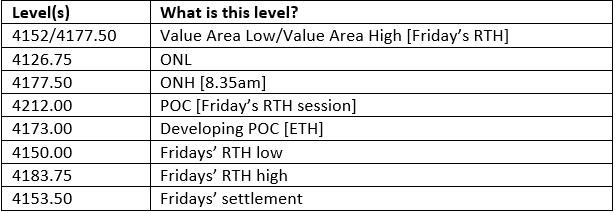

Futures gain momentum in the ON session and runs into resistance in the trade setup range posted in the playbooks for subscribers between 4181.75~4172.25 with a stop at 4205.50. If you happen to be in this trade, you did good and more than likely we will see a move towards the gap from the settlement on Friday which was 4153.50, although futures saw some continuation lower beyond the settlement. For those who are in this active trade I mention off the playbook, note that a move above 4191.50 would be indicative of a squeeze higher into that 4205.50 stop to have better chances, so make that trade of shorter duration and take profits where possible. Gap rules apply since we have gapped up nicely from Friday’s settlement. If you take a closer look at the TPO chart below which has ON participation showing clearly, notice that right from around the Sunday futures open, buyers have outnumbered sellers in the push higher to the ON high we have clocked thus far [8:15 am] of 4177.50. This is a healthy sign and the USD index is also giving up some gains here early into the push above 92. Trading today is going to be a bit tricky and I would prefer trading into the short trend from the resistance points [stops] shown on the playbooks versus long trades.

Possible Scenarios and ideas for intraday participation

Key Levels to factor for the intraday price movement.

TPO Chart