Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

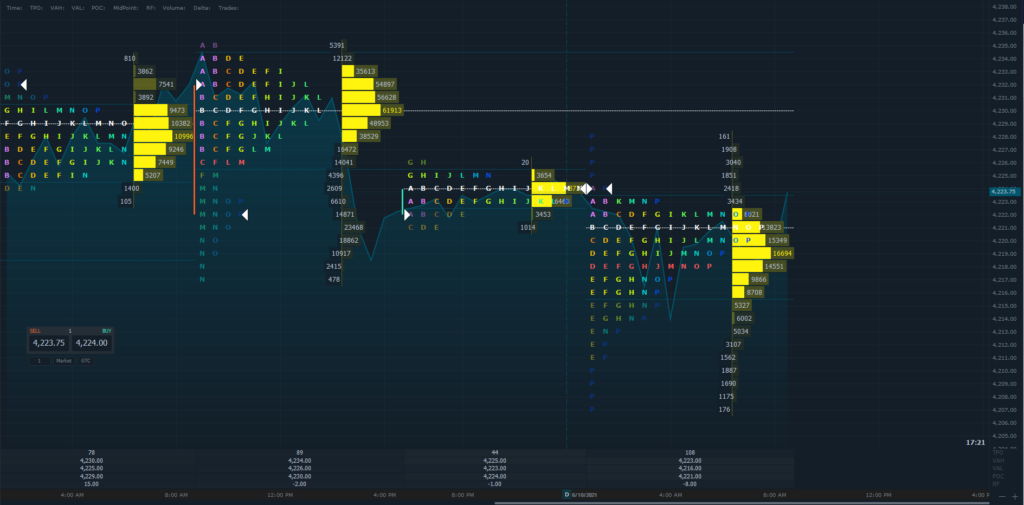

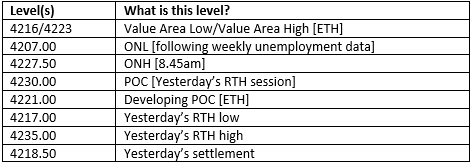

Value area has migrated lower from yesterday’s reading and the weekly unemployment news of claims falling by just 9000 for the week wasn’t what the street was expecting indicative of a sputtering restart of the economy. Regardless, we dipped in nicely below the Fibonacci stops as is customary of such days where if you happen to be in an early trade and used the traditional methods with stops; it likely stopped you out into the news event. Are you surprised? This is the way computer based trading works as the reactionary trades can be violent and will easily shakedown retail participants who are not keeping the weekly economic calendar available for viewing in plain sight before trade entries. After the reactionary trade, value appears to have returned within the developing POC area shown in the table below. We settled at 4218.50 yesterday in what was a push-pull type day where we failed to take out resistance levels or break below support levels. The bias, therefore, remains to the long side.

Possible Scenarios

Key Levels to factor for the intraday price movement.

TPO Chart