Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

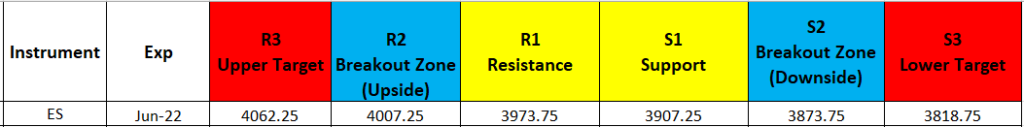

Cryptos sharply lower with bitcoin hitting its lowest level since 2020 is the big news clogging up social media channels as wary investors get stopped out or margined out. Futures for the S&P losing the 3900 momentarily in the ON session as predicted during the past sessions and it barely took us two sessions of this week to move from 4000 to 3900 and more likely than not, while we will fall below 3800 for the core of today’s session, we will attempt to scramble and keep above 3900 into the close. Do I expect a bounce around these lows? Well, for the futures 3846 area will constitute a 20% correction from the top. So that is the extent to which I will limit my price level commentary for today but keep a close eye on S2, if we drop lower, we will have a lot of room to move to S3 and that is a distinct possibility. The ON profile is indicative of a low-volume node at 3928 area. We attempted a revisit here early in the session and could attempt a squeeze higher into that zone or the settlement price either in the premarket or during the RTH session. There is good participation below the lower edge of yesterday’s RTH so participation maybe crowding in here for shorts to profits from the push lower. Overnight participation is net short.

Ideas for trade positioning for the intraday market participant

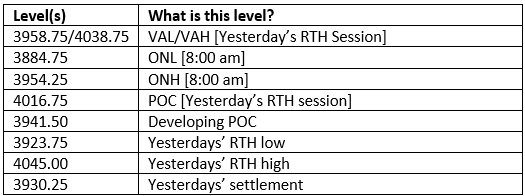

Key Levels

Support & Resistance for the intraday

Chart