Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

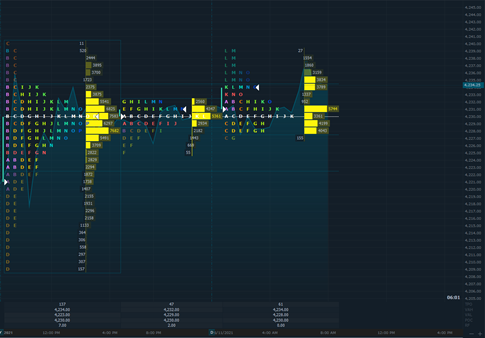

Futures have now rolled to the September expiration although volume still remains strong in the prior period contracts. The profile chart below reflects the current expiration so does the table with key-levels. Not much of a gap or departure from value when you factor overnight price action which has remained net-long. We are about 7 points above yesterday’s settlement so there are no gap rules to worry about today nor is there any market moving events in the Economic Calendar of events for today. The USD has remained strong through the overnight session as currency futures rolled overnight to the September expiration to align with equity futures roll. We could see some profit taking in the early part of the trading session today. Apart from that it would not be too far-fetched a thinking that we will more than likely hold initial support which now sits at 4219.50. Participation is expected to shift in a gradual fashion over into the September contract as the day progresses.

Possible Scenarios

Key Levels to factor for the intraday price movement.

| Level(s) | What is this level? |

| 4228/4234 | Value Area Low/Value Area High [ETH] |

| 4225.25 | ONL |

| 4238.50 | ONH [8.30am] |

| 4230.00 | POC [Yesterday’s RTH session] |

| 4231.00 | Developing POC [ETH] |

| 4208.75 | Yesterday’s RTH low |

| 4239.50 | Yesterday’s RTH high |

| 4228.75 | Yesterday’s settlement [September’21 expiration] |

TPO Chart