Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

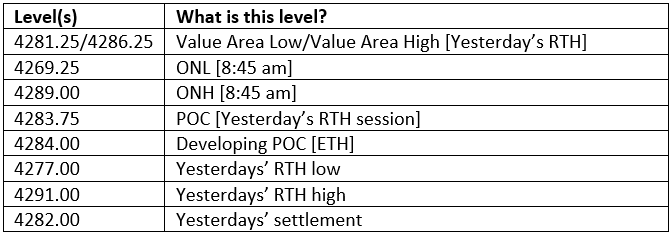

Last day of the month and quarter and ironically not much to talk about as money managers indulge in their customary window dressing which should move some sectors up favorably and the other poorly. We also has the OPEC+ meeting tomorrow which should either curtail rising Crude Oil prices or drop them in the event the group elects to add to production. Regardless, there is always the talk of additional Iranian Crude entering the markets as sanctions ease. Overnight inventory since moving past the European open [which customarily sells US equity futures], has resurrected in price some, as participants since that hour after the European open remain net long. Overnight again saw weakness at highs [4289] and strength at lows [4269 area] which puts the range at about 20 points. Futures settled at 4282 yesterday so at the time of this writing [8:45 am], there is not much of a gap to talk about. Despite warnings of a possible caution and liquidation break ahead of us from a multitude of analysts on TV and leading journals, the markets continue to be on a sideways to upward grind looking at the 4300 level as a possible initial target.

Possible scenarios and outline for trade positioning

Key Levels to factor for the intraday price movement.

TPO mapping