Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

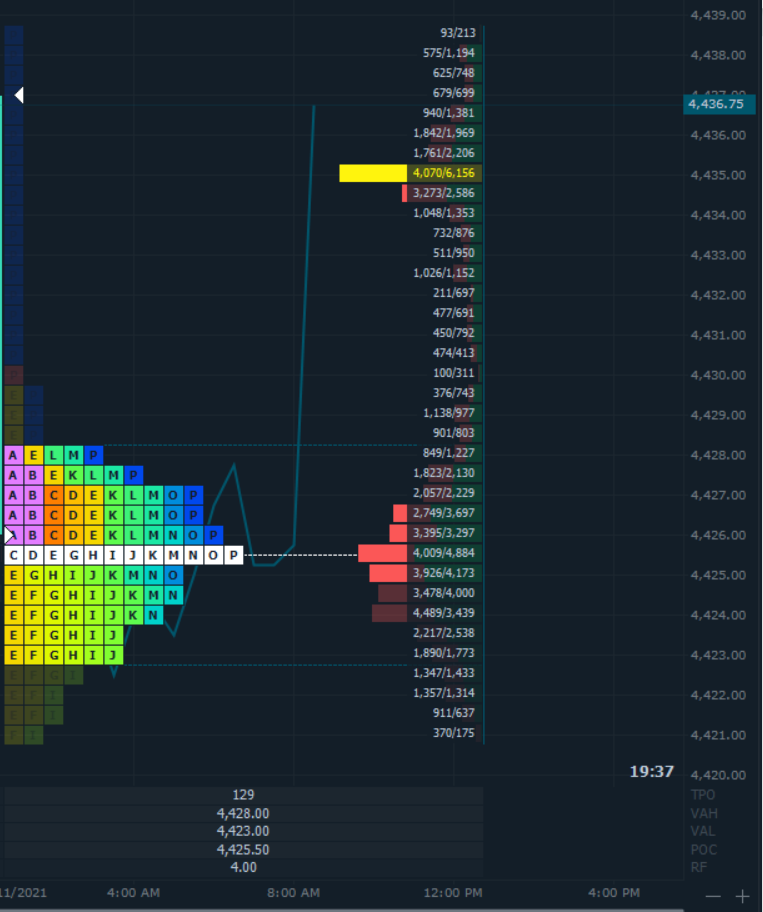

Yesterday in our premarket summary, we pinpointed under section titled “Possible Scenarios” where to position long trade ideas and where to seek profit targets. The ES market did good by pushing above the 4434 profit target and pulled back lower promptly allowing short-term participants to reverse from the top to collect another 10+ points on the path lower. While premarket analysis in general is never for guidance on trade entries or management, we attempt to give you that directional advantage by merely reading this one-pager everyday and placing informed bets in a very liquid futures market. In ON price action, futures did not swing as low as we did in yesterday’s premarket session, so ideally we are looking at a “higher low” situation into the grind today. WTI Crude which had begun to post a possible recovery in the past two sessions, is cratering again today while ironically, Gold is attempting to now hold above 1725 level. Yesterday the US Senate pushed a 3.5T budget blueprint for infrastructure spending in what is a sprawling piece of legislation. Markets ticked up yesterday on this news and futures this morning appear to be adhering to holding value. Today, we peg support at 4418.75 area which also became the area of acceleration higher yesterday and resistance persists in moves above 4436.25. Taking out the 4443.50 area would be indicative of a surge higher in future trading sessions. CPI data released a short while ago by the US BLS states that CPI for July for all things combined rose 0.5% showing that inflation is alive and well. Of importance, the food index increased 0.7 percent in July as five of the major grocery store food group indexes rose, and the food away from home index increased 0.8 percent. The energy index rose 1.6 percent in July, as the gasoline index increased 2.4 percent and other energy component indexes also rose.

Possible scenarios and outline for trade positioning

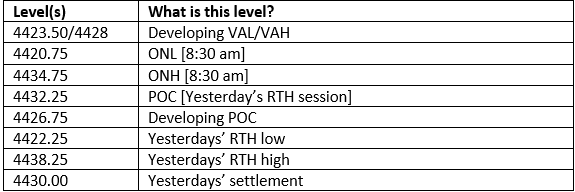

Key Levels to factor for the intraday price movement.

TPO Chart