Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

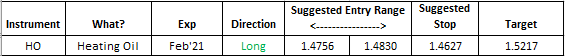

When crude oil prices are stable, home heating oil prices tend to rise in the winter months—October through March—when demand for heating oil is highest. A typical home in the Northeast may consume between 850 gallons to 1,200 gallons of heating oil in a typical winter and consume very little during the rest of the year. Crude Oil prices have steadily risen from negative readings during the initial part of the year past $20, $30, $40 and now tending to top $50. The cost of crude oil is a major component of the price of heating oil. Worldwide supply and demand determines the prices for crude oil. Demand usually varies depending on factors such as the economy and the weather. Weather events in the US and political events in other countries also often times, affect supply. The amount of oil that members of the OPEC produce most definitely has influenced the uptick in price this year off the bottom. The value of the U.S. dollar is a major component in the price of oil. A higher dollar puts pressure on oil prices; a lower dollar helps support higher oil prices. Crude oil also tends to move closely with the stock market but in the opposite direction. The USD has fallen below support in recent days against a basket of currencies. Technically speaking in our opinion, heating oil remains bullish into January’21. We present a tradeable idea for Feb’21 expiration heating oil futures below:

Trade idea

Chart