Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

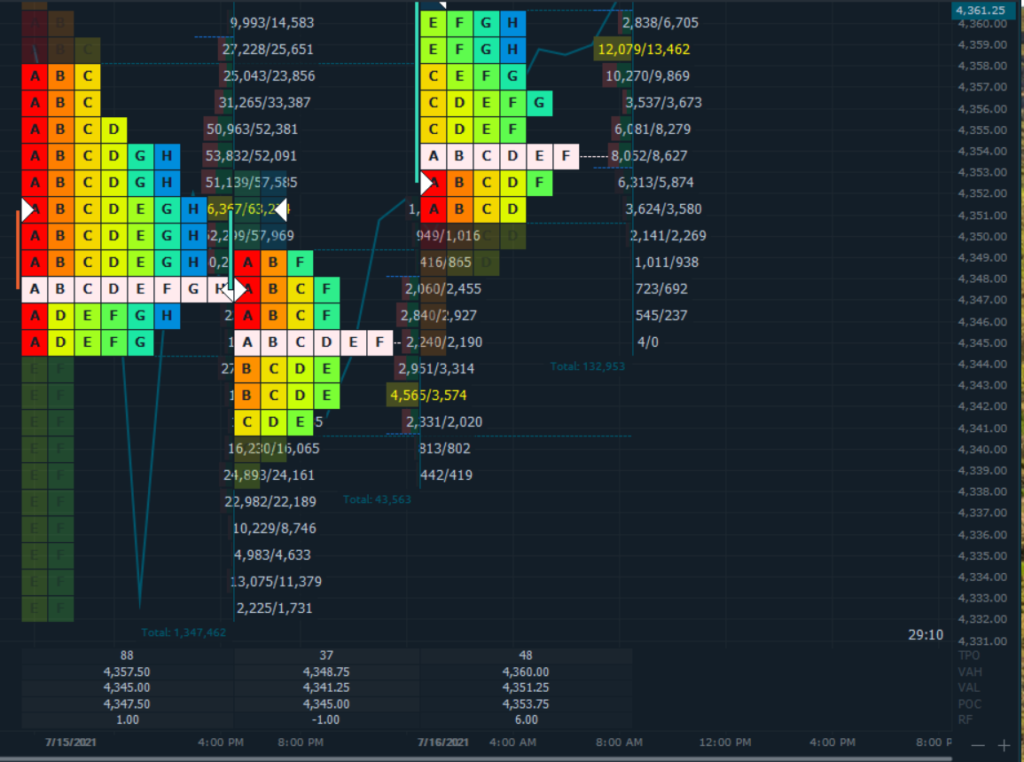

I’m thinking the markets are done with reacting with Fed Chair testimonies and begin considering that as a scenery in the rearview mirror. At least the futures price action and support from ON lows will allow us to make that assessment. Sellers still clearly outnumber buyers in the premarket price action as the POC shifts moderately higher and volume for the ON session remains healthy while skewed short above the developing point of control. Please use the playbook stops as support levels for the intraday session which now is at 4349.75.

Fridays’ usually are half-size or not at all in terms of trade positioning with the indices and today is no exception as the heart of summer in the US has vacation traveling at its’ peak and therefore volume a tad bit muted. Markets will merrily tick nicely higher or lower most times during periods of muted volume and one would notice that trend more in holiday abbreviated sessions. In economic news, U.S. shoppers boosted retail spending in June as the economy more broadly reopened and auto dealers navigated supply disruptions. Retail sales -- a measure of purchases at stores, at restaurants and online -- rose 0.6% last month compared with May.

Possible scenarios and outline for trade positioning

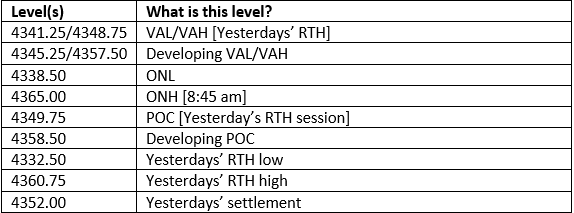

Key Levels to factor for the intraday price movement.

TPO Mapping