Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

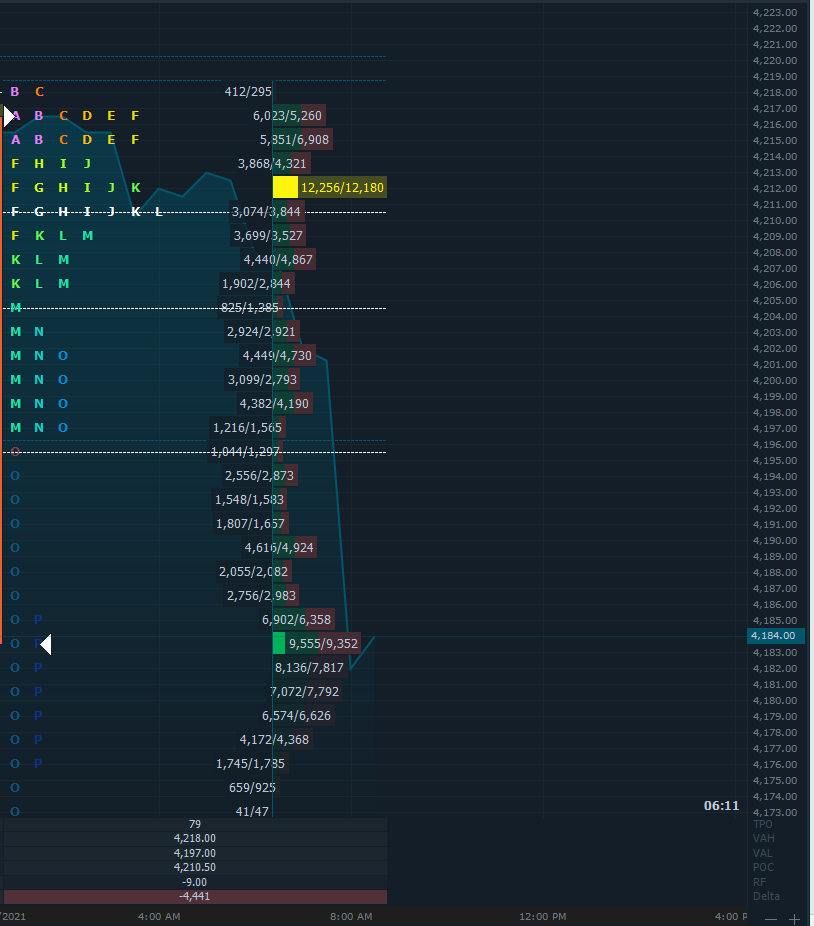

Futures lose momentum and run into resistance early into quadruple witching Friday. We have gapped nicely lower from our settlement yesterday and gap rules do apply. If you need the gap rules, visit us at our website and fill out a contact form and we will have the office mail you one; surely it will become a keeper in your toolchest of trading. The first sign of exhaustion seen was at 4218 right after the European open when we had very few contracts on the buy side and the sell side mounted at 4212 area just above the then developing point of control. Recognize the fact that we are not just spewing out material for you to read from price points pulled out of thin air but from market generated information. It is only the interpretation of this information and how you would look at it as a short-term participant of the market is what is of relevance in this one-page report that we put out each day.

Possible Scenarios and ideas for intraday participation

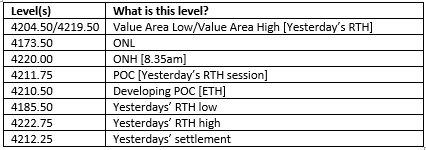

Key Levels to factor for the intraday price movement.

TPO Chart