Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

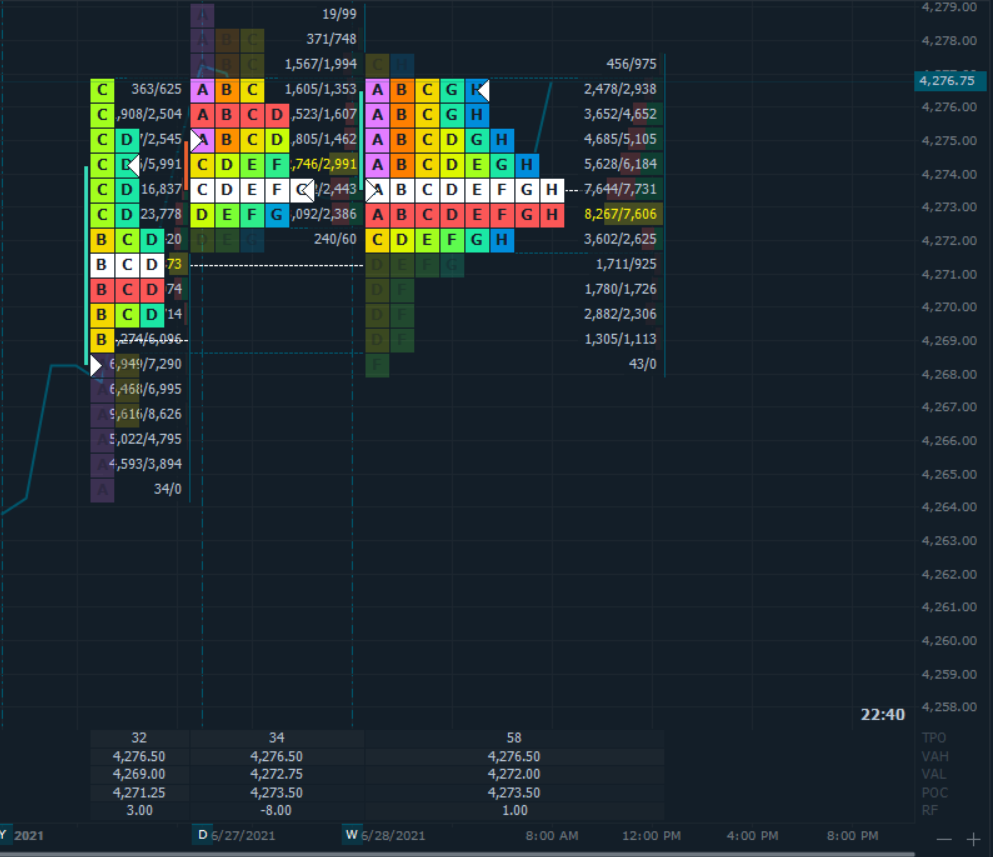

The overnight price action from the Sunday futures open at 6 pm, managed to pull only a net of 43 contracts at the 4268.50 price point which were all buys. Since then, the volume has been skewed to the buy side when at or below 4272 and sellers crowding the deck above. I am not expecting much today in terms of a range as we will likely witness the same slow troubling grind up scenario more thank likely finding support at the ON low and resistance as we move higher. Valuation, past the Friday close remains unaffected by ON participation and volume at these highs remains a tad bit muted. Friday’s settlement was 4271.25 so no notable gap to speak about. There are untested points of control below however in the 4256 and 4239 areas so if sellers have their way today and want to push things lower, those are price points which will involve some capitulation and more than likely will draw some long position seekers into the game.

Possible scenarios and outline for trade positioning

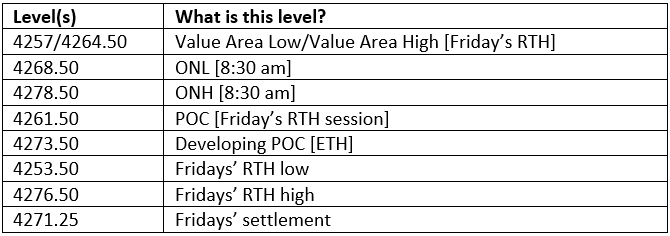

Key Levels to factor for the intraday price movement.

TPO Chart