Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

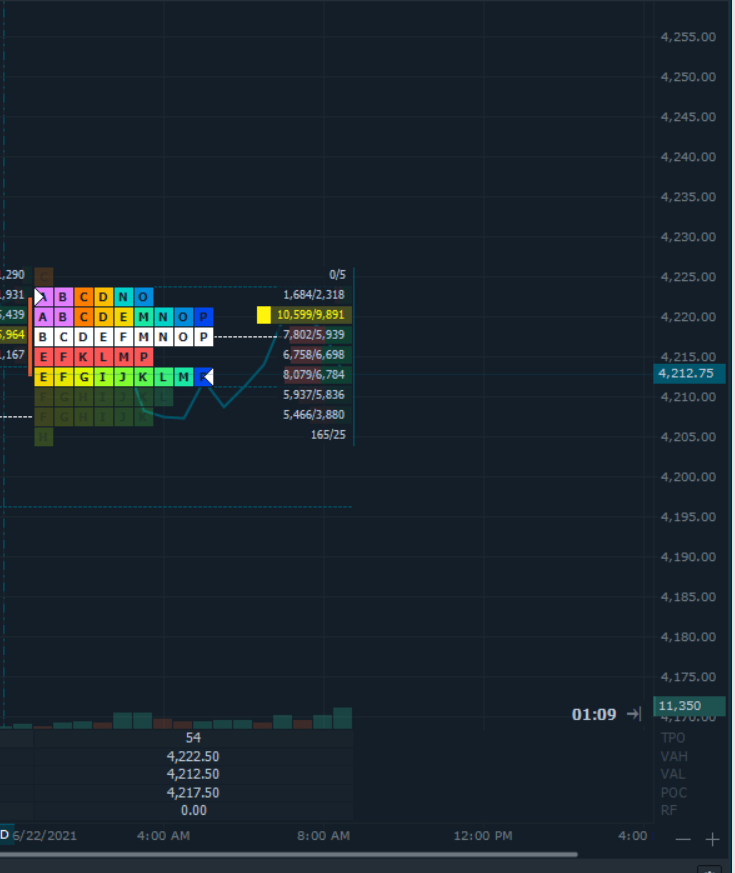

Emini S&P futures halted in the move higher in the overnight session from the momentum derived from the day session and pulled back on profit taking to make an overnight low of 4205.75 as buyers stepped back in an hour or more past the European open. At the peak of the high yesterday however, we began seeing sellers crowding in to take profits as the poor high structure into the close was indicative of a short into the ON session having the possibility of yielding some good returns which could serve as a cushion for intraday trading. We have a downloadable link available for the TPO chart at the cash close from yesterday so if you are interested in that view and with a brief interpretation of the cash session, please visit us at our website and drop us a note. The excess into the poor high ranged from 4218.50 into the 4226.25 continuation which occurred right into the calendar flip to June 22nd so single prints ruled that structure and it was imperative that shorts would’ve prevailed and they did for a good 20+ points into that hour or more past the European open. Tradeable patterns exist at most times during and after RTH, and a TPO chart allows traders to put things into perspective before positioning themselves with limit orders into the overnight session.

Possible scenarios and outline of a trade plan

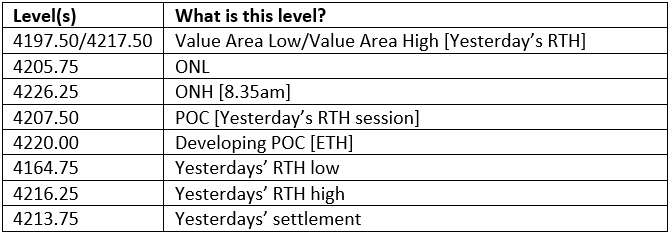

Key Levels to factor for the intraday price movement.

TPO Chart