Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

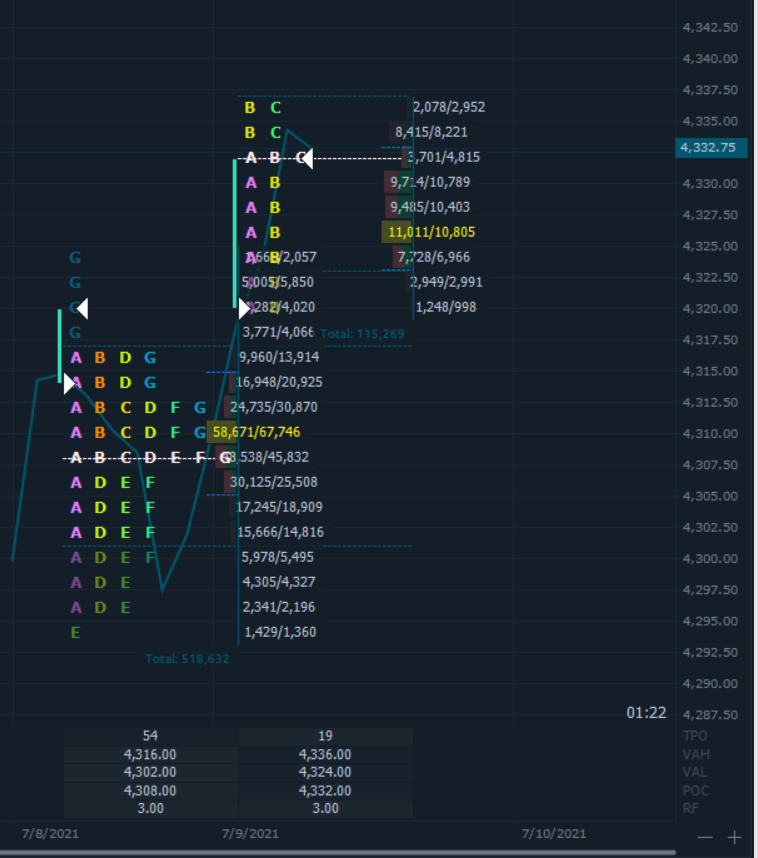

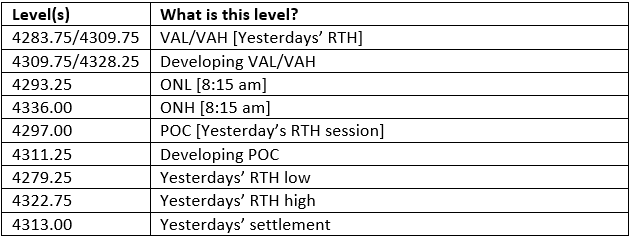

In the opposing measured move scenarios posted with the playbooks yesterday for subscribers, futures elected to hold the drop lower just below the POC at 4293.25 while finding support off the opposing long entry and just riding it higher past the European open which ironically did not short US futures heavily in the ON session as they usually do. If you take a closer look at the TPO map below, buyers and sellers appear around evenly distributed above 4320 which could work as support in the intraday as bears have been quickly giving up on squeezes. The ON price action saw maximum contracts traded around 4305 so if a liquidation similar to yesterday were to occur again [which on the surface of things and the ON move appear remote], there would actually be no untested VPOC’s to uncover unless we pushed drastically lower below yesterdays’ low of 4279.25. We have gapped nicely higher from yesterdays’ settlement so gap rules do apply so traders on either side of the fence need to be cognizant of those rules.

Possible scenarios and outline for trade positioning

Key Levels to factor for the intraday price movement.

TPO Mapping