Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

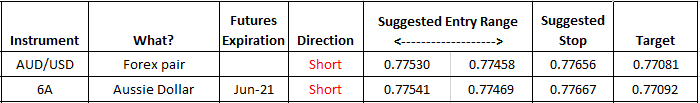

In intraday trading today AUD/USD has turned lower after failing to decisively breach above the 0.7760 level shown on the chart below for the spot pair. The currency pair appears headed back toward a measurable SMA [50-period], which could offer support as it has since early April. Bearish momentum appears to be grabbing hold as the USD strengthens against the basket of currencies it measures against. The MACD looks to be on track to cross below its center line, and denotes markedly a bearish signal. While the AUD did fair better today as compared to the NZD, it still appears to be headed lower. We present the trade idea in an actionable table below and chart of the spot pair to allow forex traders to assess and trade. Always use stops as we have shown in the trade idea below. It allows short-term market participants to remain in the markets versus "hoping" for a price recovery to their original trade entries or decisions.

We are currently active in this trade as follows:

a. Initial entry 0.77530 [Took profits on this entry at 0.773000

b. Re-entry short at 0.7746 [Trade remains open targeting below previous profit taking levels]

Trade idea

Chart