Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

Overnight inventory appears to be net long into and into the Point of Control which sits at 4390.75 off of yesterdays’ RTH session. There is a general fishing for direction right now. The strong underpinning of the market is that there is a lot of capital waiting on the sidelines, waiting for an opportunity to enter, and that means any corrections are very short lived. This is exactly what we witnessed yesterday. Fed officials are set to conclude their two-day policy meeting today, with a statement due to be released at 2 p.m. ET. The focus will be on any signals from Chair Powell about whether policy makers are accelerating deliberations over how and when to pare back on their easy-money policies, and any shift in the Fed’s view on inflation. Valuation hasn’t drifted much lower despite the structured liquidation yesterday when we covered a few virgin points of control which were left untested and now remain fulfilled again, despite several poor structures lower from the move above about 4050 which still remain untested and will likely become important on a major break lower. Today is critical and advisable to stay clear of index futures after about 1:30 pm up until which point there will likely be less activity. Yesterdays’ tech earnings and guidance from tech leaders like Apple, Microsoft, Alphabet were robust and the aftermarket price action there did not justify the earnings or guidance and will likely be better reflected here during the day session.

Possible scenarios and outline for trade positioning

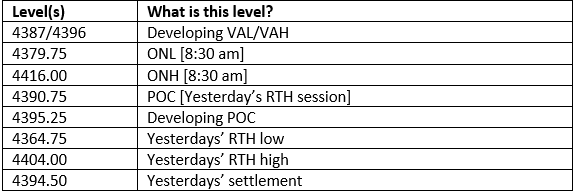

Key Levels to factor for the intraday price movement.

TPO Profile