Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

It is safest to merely ignore the price action in the abbreviated session for equity index futures that occurred between the Sunday 6 pm open and the 1 pm Monday close. There are several “Poor lows” in the structure of the Emini S&P from the past 15-odd days. Momentum trading participants have simply squeezed this higher leaving several virgin “untested” points of control in the grind higher. Into the start of Q2 earnings which commence next week, there appears to be growing interest in equities from money managers and retail participants and the turn of the quarter window dressing did not do much damage to stocks. The Russell however is markedly weaker and that is usually the “risk on” or wildcard market for lack of a better phrase. In overnight news related to the most trending companion in futures with the S&P, Crude Oil ran into a stalemate in the OPEC meeting in disagreement between the largest producers the Saudi’s and UAE so output decisions will likely remain the same as they were from the previous agreements. In the economic calendar of events for today, we have ISM and Final Services PMI which are usually not much of market affecting news; however an uptick is indicative of an economy returning back to it’s feet post pandemic despite the dole out of assistance related to unemployment. Important also to take notice of is the interest in the long bond [ETF: TLT] by participants which usually isn’t there in a situation with rising equity values.

Possible scenarios and outline for trade positioning

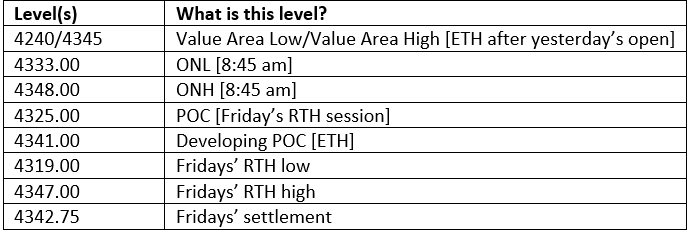

Key Levels to factor for the intraday price movement.

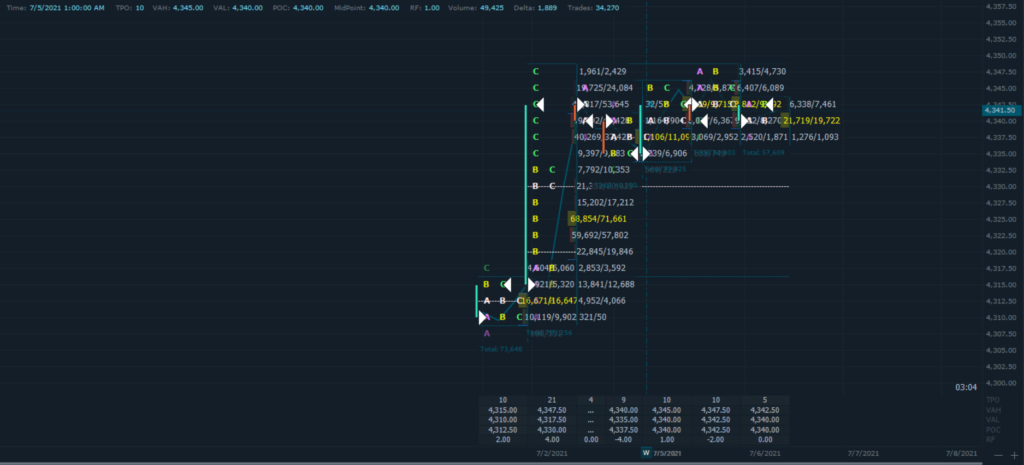

TPO Mapping