Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

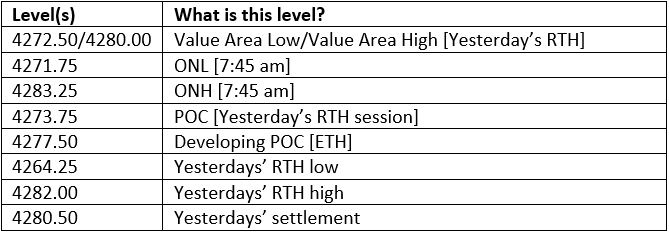

Buyers outnumbered sellers in the overnight price action and into the ON low [4271.75] as of 7:45 am this morning. Participation reverses with sellers jumping in on moves above 4280 which tells me it is going to be another range bound day today and the only way there is going to be some range expansion would be when buyers elect to push above ONH [4283.25] and attempt to keep above yesterdays’ high of 4282. In short, there isn’t much of a story to tell from the market generated information from overnight trading as we are holding Fib support of4271.50, and clearly held that level thus far in the premarket and at the time of this writing at 7:45 am. Given the overnight price action, I would consider looking at initial resistance at 4285.50 and support just below the ON low at 4270.75. That narrows the range down some more today to about 15-points and I would be pleasantly surprised if we breakout to either side today. In the economic calendar of events for today, FOMC member Barkin speaks at 9 am at which time we also have the Housing Price Index, which essentially measures the change in the purchase price of homes with mortgages backed by Fannie Mae and Freddie Mac on a monthly cycle. At 10 am we have the Consumer Confidence numbers based on a sampling survey of households which in my opinion is one of the most subjective measures.

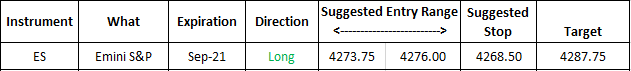

Possible scenarios and outline for trade positioning

Key Levels to factor for the intraday price movement.

Trade idea

TPO Mapping