Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

In the overnight price action, at almost each TPO, sellers appear to be out numbering buyers from the move which commenced of the 6 pm open yesterday. Only the ON low prints between about 4253 and 4256 generated more buying volume compared to the selling from a view of the TPO chart. Oddly enough, the Nasdaq futures are a bit sluggish today while the “risk-on” index the Russell continues to tick higher. We would advise caution to long traders as Friday could involve some profit taking.

Possible scenarios and outline for trade positioning

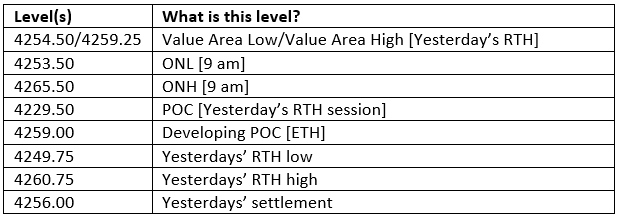

Key Levels to factor for the intraday price movement.

TPO Chart