Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

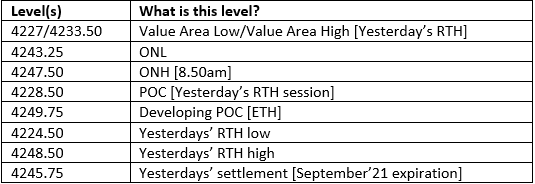

Decent accumulation/distribution occurring in the ON session with the current contract from around 4250 which in the premarket timeframe has seen the most contracts traded. Point of Control from yesterday’s RTH sits at 4228.50 so we have moved higher nicely and are developing above 4250 in the Extended Trading Hours [ETH]. We had a poor high into the close yesterday moving up on single-prints from that point of control [4228.50] all the way past 4248. That entire price action therefore begs for revisitation in order to reestablish participation which while occurring in the RTH yesterday, was thin by comparison to the price range of 20+ points that we established in about 27,660 net contracts traded during the last half-hour into settlement which was at 4245.75. Core CPI numbers released at 8:30 am saw a 1.3% decline m/m.

Possible Scenarios

Key Levels to factor for the intraday price movement.

TPO Chart