Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

Australia’s key commodity exports. Iron ore, thermal coal and oil prices have all increased further since the previous Statement, while a number of other commodity prices are also higher. The benchmark iron ore price has increased by

16 per cent since the previous Statement to beat its highest level in a decade. Demand for iron ore has been supported by the continued strength in Chinese steel production, and steel mills continue to build iron ore inventories while profit margins are elevated. Chinese authorities have signaled a desire to keep steel output in 2021 capped at or below 2020 levels, which may put downward pressure on iron ore prices in the second half of this year. Steel mills in some steel-producing cities in China have been instructed to lower production for the remainder of the year to reduce emissions. On the supply side, recent cyclone activity has reduced iron ore production in Western Australia, while market expectations for Brazilian exports for the remainder of this year have been revised down following recent lower-than-expected production. In summary, economic activity support a strong Aussie.

Earlier in May, The Bank of England’s Monetary Policy Committee (MPC) sets monetary policy to meet the 2% inflation target, and in a way that helps to sustain growth and employment. At its meeting ending on 5 May 2021, the Committee judged that the existing stance of monetary policy remained appropriate. The MPC voted unanimously to maintain Bank Rate at 0.1%. The Committee voted unanimously for the Bank of England to maintain the stock of sterling non-financial investment-grade corporate bond purchases, financed by the issuance of central bank reserves, at £20 billion. The Committee voted by a majority of 8-1 for the Bank of England to continue with its existing program of UK government bond purchases, financed by the issuance of central bank reserves, maintaining the target for the stock of these government bond purchases at £875 billion and so the total target stock of asset purchases at £895 billion.

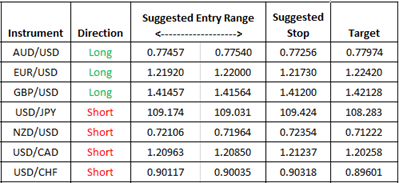

Here are trade ideas for a basket of forex pairs for the overnight session on Thu May 20th, 2021. We are currently in each of these trades from within the entry range and in the direction shown: