Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

Aussie Dollar: The strong recovery in the Australian economy and the labor market has continued. Low infection rates, substantial fiscal and monetary policy support and a lift in confidence have boosted the recovery. Household spending,

dwelling investment and exports have all contributed to the snap back in activity. Employment has also bounced back, to be above its pre-pandemic level, and the unemployment rate has declined significantly from its peak in July 2020. Policy measures are supporting the economic recovery, but a rebalancing of public and private demand is underway. The outlook was stronger than expected at the time of the previous RBA statement, but it remains uneven as the pandemic continues to weigh on parts of the economy. The unemployment rate has declined rapidly over recent months to reach 5.6 per cent in March.

As a result and owing more to the weaker than expected employment numbers in the US, the Aussie dollar continues to measure stronger against the USD.

Technical Analysis

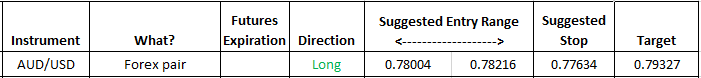

AUD/USD from early last week when we saw a bottom at 0.76744, has methodically ticked up and remained steady against the USD with the next series of swing lows at 0.77007 and 0.77606 respectively. Fib analysis using just this most recent swing low and measured to yesterday’s high of 0.78903 places the halfback at 0.78004 with the Fib 38.2% retracement at 0.78216 offering support in the intraday today. As is customary for us, we take the initial position at the top end of a trade idea and scale in at the bottom of the range if the position moves against us while all the time respecting the hard stop. That trade idea, and for this instance alone, measured purely on Fibonacci is presented below and we are currently active in this trade long from 0.78216 with 1 forex contract.

Trade idea