Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

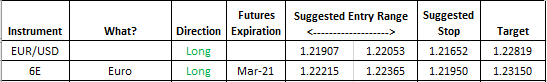

Yesterday [Dec 21, 2020] saw weakness in US equities and index futures in what appeared to be a very late reaction from the breaking news which came out from the UK Health department during the trading session this past Friday that there was a different mutation of the Corona virus which had a 70% higher spread and infection rate. US futures careened lower on Sunday into Monday as countries closed their borders to the UK amidst uncertainty and risks tied to this new mutated version of the virus. The USD gained strength against a basked of currencies and precious metals lost their momentum only to see US equities stabilize into the close on Monday. It appears that nothing really stalls the US stock market anymore. Bad news converts into "buying the dip" every single time. This morning, it appears the USD is giving up some ground to that same basket of currencies beginning with the Aussie dollar and moving on to the British Pound and the Euro. For intraday traders of forex and currencies this presents an opportunity and we help you with an actionable trade idea below: