Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

Currencies were trading lower this past Friday on fading hopes for both the weekend meeting related to Brexit and Congress breaking session for the holidays ahead of any stimulus deals in the US. For most of this year, investors have traded on the speculation that the British leadership would give in and agree to an orderly exit out of the European Union. However, with only a few weeks before the deadline, the final round of Brexit talks are failing quickly, with both sides preparing contingencies. In the U.S., lawmakers passed a one-week spending bill to fund the government, but the House has indicated that anything beyond that would require agreement to a broader fiscal stimulus plan. Unfortunately, very little progress has been made and the Republican led senate reckons that they do not have majority support for the current bill. In the event of no agreements this week coming up, we could see sharp year-end losses in major currencies and equities.

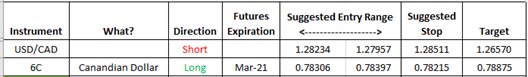

USD/CAD hit a fresh 2.5-year low on Thursday before finding a short-term bottom on Friday. The pair is deeply oversold and due for a stronger recovery. We present our trade idea for the USD/CAD as a short-term trade idea for forex and currency traders: