Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

The AUD/USD is jumping to new all-time highs alongside the stock markets. Budding optimism over discovery of a viable vaccine to combat the pandemic spurring global growth and a rebound in business activity post-pandemic is helping fuel demand for global growth-linked assets and currencies, like the Australian, Canadian, and New Zealand Dollars. Each of the commodity currency central banks – the Bank of Canada, Reserve Bank of Australia, and Reserve Bank of New Zealand – are expected to “kick the can down the road”, figuratively speaking and not tinker with existing interest rates. Retail trader positioning suggests that the commodity currencies are on mostly bullish footing (bullish AUD, NZD; neutral CAD).

Usually, the week before Christmas is pivotal for financial markets, in what will be the last ‘full’ trading week of the year. With Christmas Day the following Friday and New Year’s Day the Friday after that resulting in otherwise shortened trading weeks also involving “low volume trading” , the economic calendar is about to thin out significantly. But before that happens, there are several central bank meetings due scheduled for the week ahead.

For a reasonable price analysis we usually zoom out at least to the 20D 1hr chart and see that the Fibonacci retracement could hold support between 0.74975 and 0.74800 for the spot price of AUD/USD, as prices slash through the November highs.

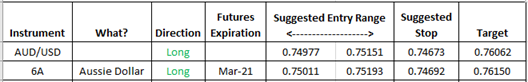

We present the trade idea for AUD/USD and for the base currency AUD [or simply 6A at some brokerages].