Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

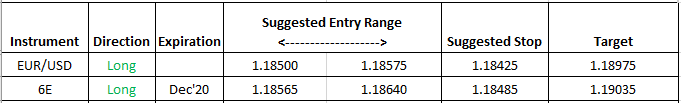

The weakness in the greenback has contributed to a bit of movement in a basket of currencies that measure well against it. On Thursday Nov 19, 2020 we made a low very early ahead of the European open at 1.18157 and began moving higher but pulled back sharply ahead of the US market open almost with the intent of retesting that low but stalled at 1.18182 and the price action has not looked back. Ironically though, despite the weakness in the USD, precious metals have not made much of a showing. This minor move now measures with anchors from that 1.18182 intraday low to the 1.1882 post US market close high has a halfback long at 1.18500 with a stop if you trade this at 1.18425 and a profit target of 1.18971. We present the trade idea in the form of a simple to read grid below and have the forex pair alongside it's future which trades on the CME with symbols like EUR or 6E: