Interpreting market movements in a whole new way

Interpreting market movements in a whole new way

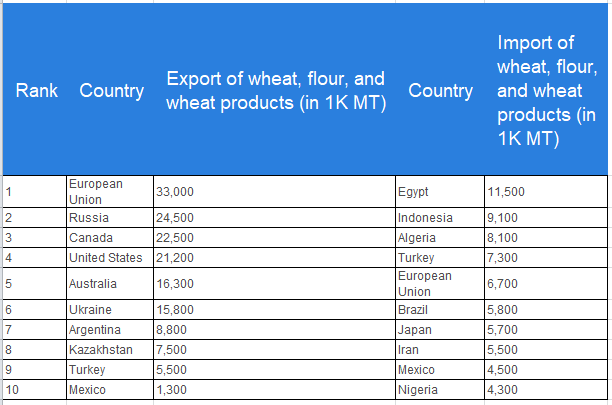

While trolling sites that provide price perspective on commodities, often times you find articles with the heading such as “Where are Wheat Prices headed”. How much attention as a trader, hedger, investor, dealer or producer do you pay to these types of reports? Do they add value for you in the short-term and allow you to hedge effectively? Well ask yourself that question and then try and figure out how many times in the recent past you have read such a report from experts on here or on other sites and profited from it. Yes, we all know the answer to that question so let me not bore you with more of the same. Fundamentally we ought to take a close look at the countries or regions that produce Wheat and consume Wheat or Wheat related products. I present a picture below from a couple of years ago and not much has changed in this scenario in 2 years:

And then you hear and read about all these tariffs and trade wars that apparently the POTUS has got our nation involved with and that our farmers are suffering from this move by our current administration. I hope that you are not seriously a believer in this type of rhetoric. I mean, ask yourself this question what incentive does a man who became the Head of State by chance and who is not a career politician, have to do with hurting our countries farmers with initiating trade wars? Ok, politics aside, so why did I present this table above? Think for a bit where is China on this list? Yes, we have a war of words brewing with Turkey but for crying out loud, Turkey produces about as much of Wheat and exports it out as the Wheat related products that it imports! Now thank yourself if you are a Wheat farmer that China is not a big producer of Wheat otherwise you know what they could do to all of us I mean take a step back and analyze what happened to the price of Steel over the past decade!

The price of a commodity moves fundamentally for a few reasons. If it is a crop like Wheat then it is the weather and the harvest and more important, the monetary policy that controls the currency which measures the price of that commodity. So who controls moves in the currency? It is our Central Bankers and nations like China who can easily manipulate their currency as they did not too long ago if we get into an extended trade war that hurts their economy. Let's not forget the COTS report too. A recent reading of the Commitment of Traders report places that view into the following table:

But let us not take our eye off the ball. At TradeGuidance, we are here to help you analyze of where the price of Wheat could perhaps be headed in the near term horizon. Earlier this month we saw a huge spike in the price of wheat which lasted about a few minutes and the range was from about $560~$593. And yes, we retraced as quickly as we spiked up. But technically, what does that do? It sets a channel for the price and which leads to our analysis. We believe that for the short-term (4-6 weeks), staying above $549.50 puts upward pressure for the price and we put the price target at about $609.60. If we do not hold between $537.65 ~ $549.50, we may be headed lower for that same short-term. Build your hedge or trade plan using this analysis.